With 2023 drawing to a detailed and the U.S. shares up over 20% year-to-date, many traders are questioning whether or not this yr’s marketplace momentum will proceed into subsequent yr. In fact, we will’t know the longer term, however marketplace historical past has been an excellent information in recent times.

As an example, following the huge decline we skilled closing yr in 2022, I argued that 2023 will have to be an up yr in keeping with historical past:

So the place does this depart us? If giant down years have a tendency to be adopted by means of giant recoveries, however yield curve inversions have a tendency to be adopted by means of nearly anything else, is 2023 much more likely to be an up yr or a down yr?

The solution is—an up yr. Why? As a result of, traditionally, maximum years are up years for U.S. shares. If truth be told, in more or less seven out ten years since 1900, U.S. shares have generated a favorable actual go back.

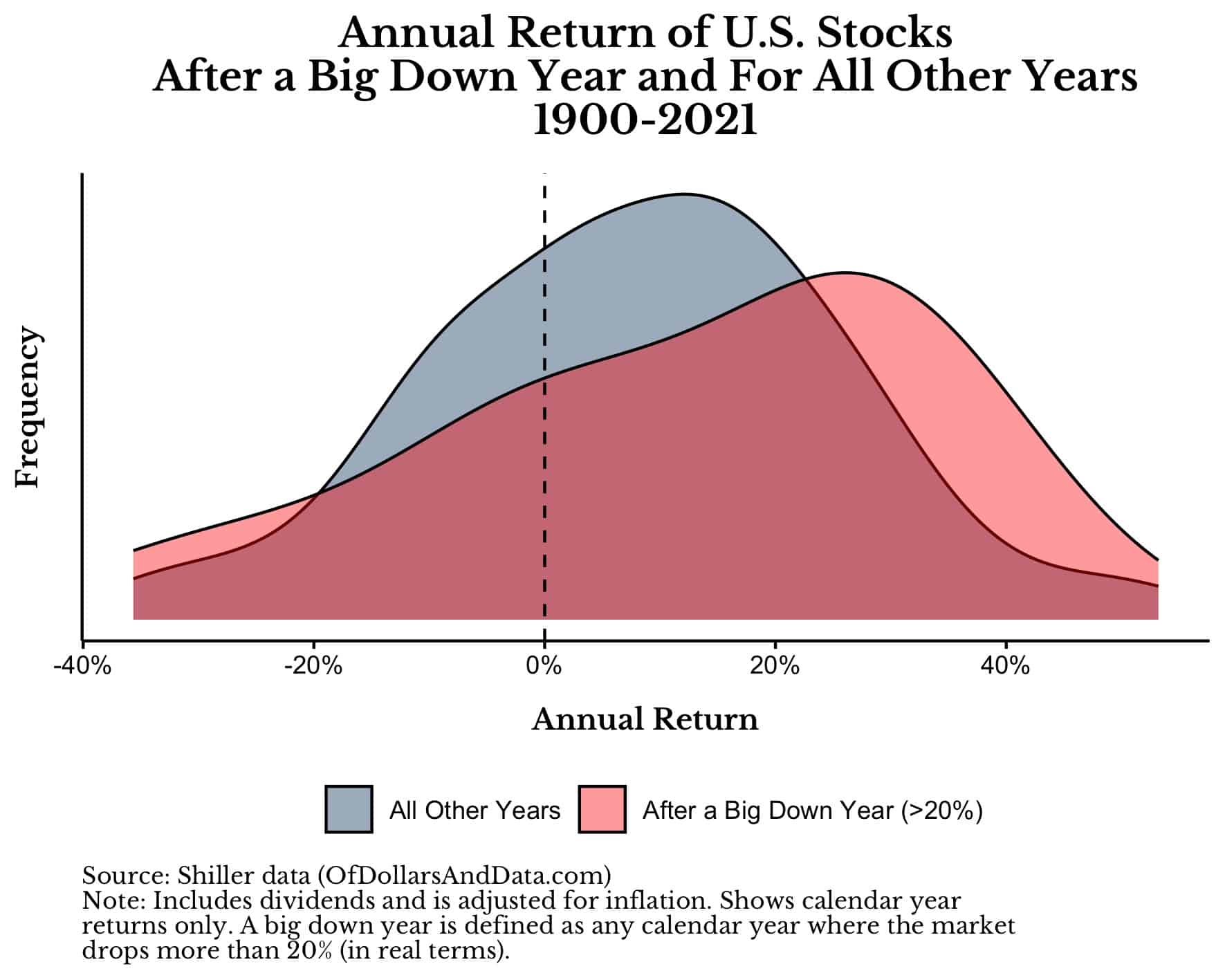

The distribution of U.S. inventory returns following a large down yr additionally supported this conclusion. As you’ll be able to see within the chart under, U.S. shares generally tend to have greater sure returns following a large down yr (>20% decline) compared with all different years:

In fact, the go back distribution after a large down yr additionally contained extra unfavorable returns as smartly (the bigger mass at the left facet), however the sure returns have been much more likely.

Lo and behold, in 2023 we noticed an annual go back that mainly matched the height of the “After a Giant Down 12 months” go back distribution (i.e. within the 20%-30% vary). It’s as though the use of historical past as a information can if truth be told paintings. If we have been to make use of this identical way to determine what 2024 may have in retailer for us, what would we conclude?

Historical past suggests—some other up yr.

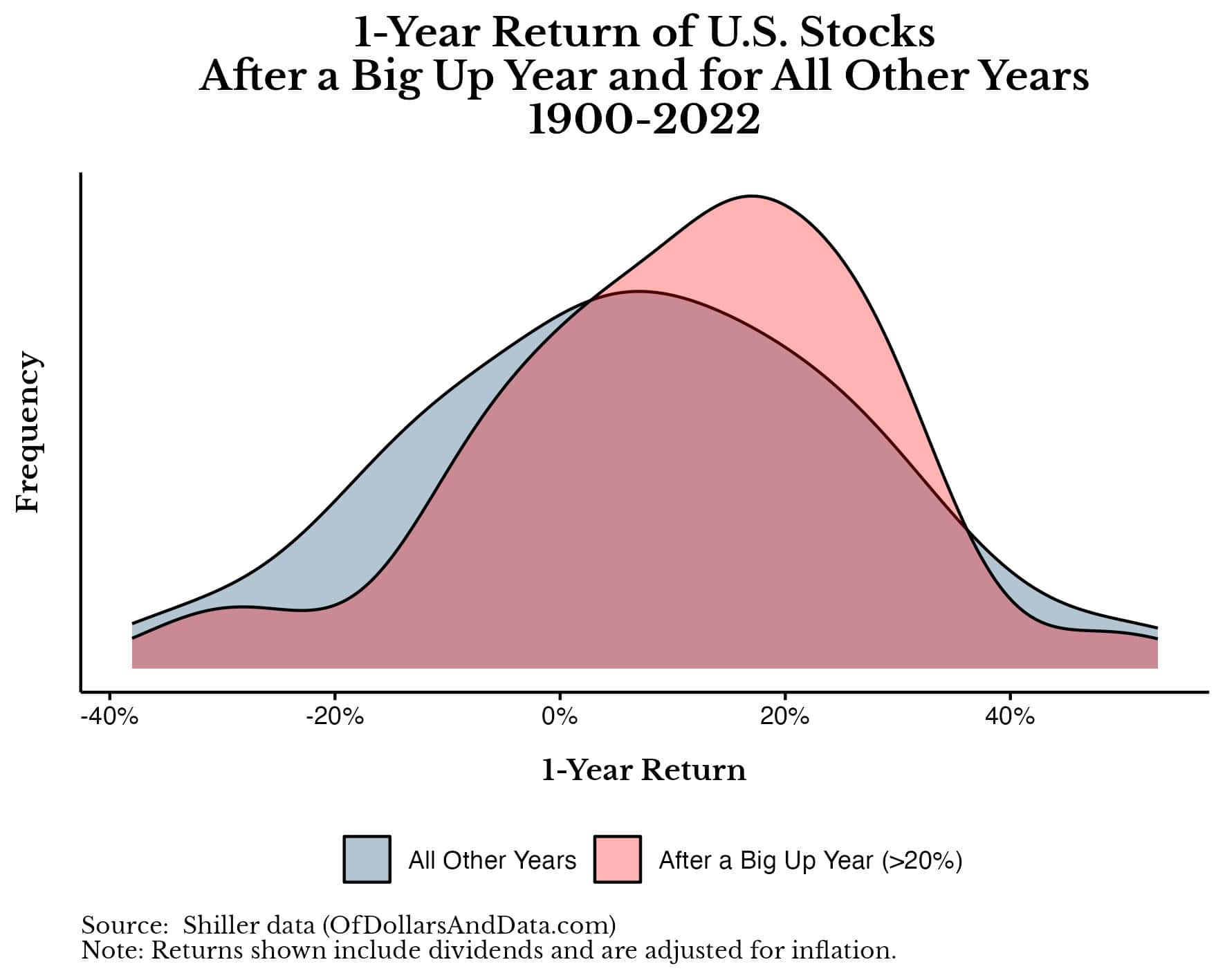

I do know I sound like a damaged file, however that is the place the knowledge is leaning. As an example, if you happen to have a look at the distribution of returns within the yr following a large up yr, you may see that the ones returns are normally upper than the returns in all different years:

Particularly, the common 1-year go back following a large up yr is 11% when compared with simply 7% in all different years. Even though this distinction isn’t statistically vital on the 5% stage, it means that marketplace momentum isn’t a whole fluke. I’ve demonstrated this prior to now when discussing why it’s k to shop for in any respect time highs.

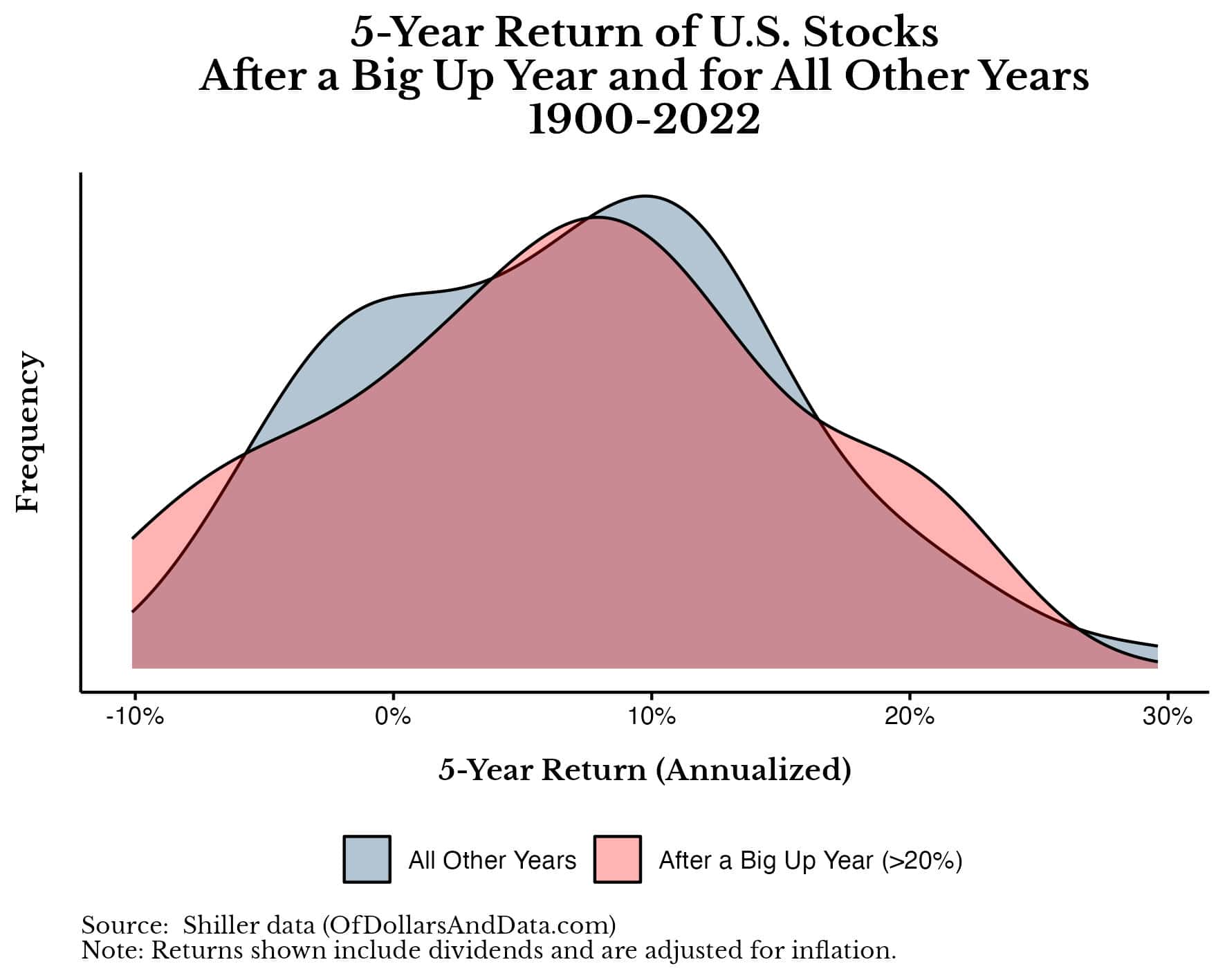

Sadly, these kinds of upward developments don’t closing eternally. If we have been to devise the go back distributions over the following 5 years following a large up yr (in opposition to all different years), we’d see that any form of momentary momentum turns out to have pale away:

As you’ll be able to see, the distribution of 5-year returns following a large up yr are just about similar to the 5-year returns amongst all different years. Those plots means that whilst up years generally tend to observe up years (over a 1-year length), this momentum ultimately fades away.

That is my expectation for 2024 (and past). Markets will transfer upward till some catalyst knocks them off observe. In 2008, this catalyst used to be defaulting mortgages that resulted in a monetary disaster. In 2020, it used to be the COVID-19 pandemic. And, in 2022, it used to be traders waking up to the prime valuations of 2021.

What is going to reason the following marketplace decline? I don’t have any clue. It is usually a geopolitical tournament, a local weather disaster, or some other provide chain disaster. However, no matter it’s, it’s going to be unpredictable forward of time. If it weren’t, then the marketplace would already be pricing it in.

The excellent news is that markets generally tend to get better from those declines and proceed rising. Alternatively, this isn’t true for all markets the entire time. However, it’s been true on an international scale for the closing century. That’s what actually issues.

I do know that some traders will learn my prediction for 2024 and conclude that I’m simple-minded or naive. “In fact he thinks 2024 can be an up yr. He thinks yearly can be an up yr.”

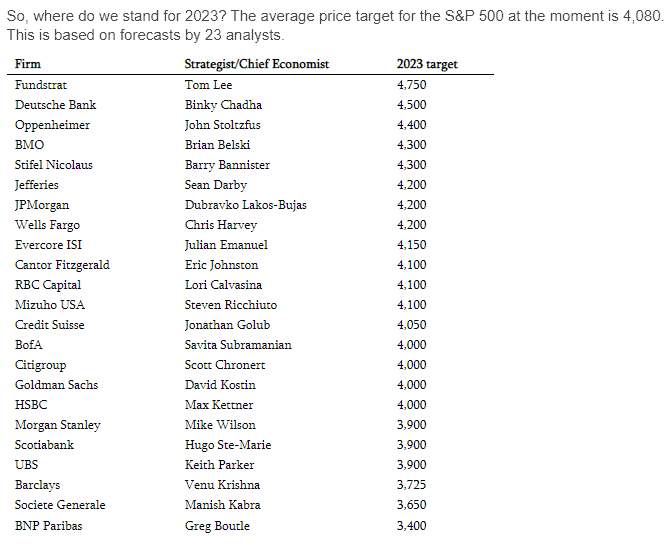

That’s no longer precisely true, however my way of the use of the bottom fee of historical past is much better than what maximum analysts do when they are trying to are expecting the longer term. If truth be told, they’d get a long way higher effects by means of being repeatedly bullish than doing what they’re doing now. That is what famous permabull, Tom Lee, did closing yr and he ended up having probably the most correct value goal for the S&P 500 in 2023 amongst 23 other analysts:

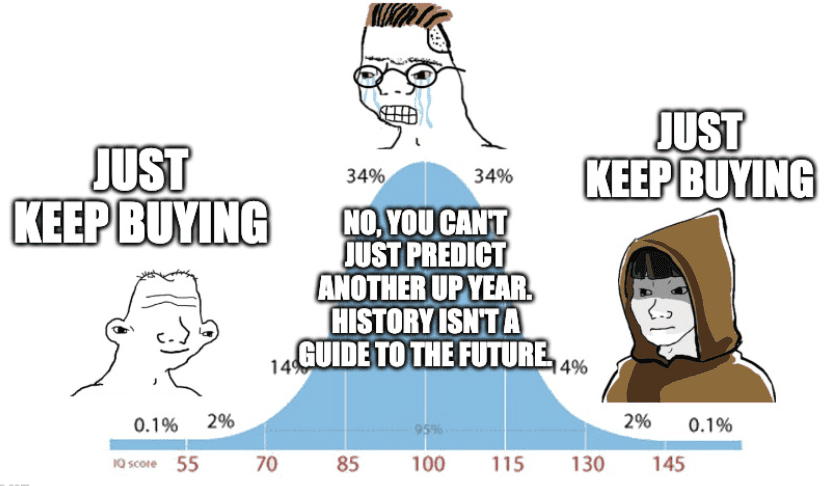

The issue with the use of historical past as your information (and being most commonly bullish) is that it by no means makes you sound sensible or refined. However sounding sensible and being proper are two various things. Sadly, some other folks would slightly seem like improper geniuses than proper simpletons.

Their downside is failing to comprehend that the naive, unsophisticated way is the fitting way. It’s this meme on repeat:

Nonetheless, there can be those who consider that it may well’t be this easy. However, it’s.

It’s uncomplicated, however no longer simple. It isn’t simple to look at shares fall by means of 7% in an afternoon. It isn’t simple to look charges upward thrust whilst inflation soars. It isn’t simple to witness other folks getting wealthy from magic web cash. No matter 2024 (and past) brings received’t be simple both. However, the method to get via it’s going to stay unchanged.

So you’ll be able to both attempt to are expecting the longer term (and most probably fail) or you’ll be able to take regardless of the marketplace throws at you in stride and stay shifting ahead. The selection is yours.

I made my selection again in 2017. That’s once I first penned the time period “Simply Stay Purchasing.” However, it used to be handiest an concept again then. I had by no means if truth be told examined it with my very own cash. However overdue 2018 modified that, then 2020 modified that, and 2022 modified it over again. The method didn’t simply paintings in backtests, it labored with actual {dollars} at the line too.

It labored when other folks referred to as me an fool in 2020. It labored after they stated “this time is other” in 2022. And it labored after they referred to as for a recession (that by no means materialized) in 2023. And it’s going to paintings someday as smartly.

So will 2024 be an up yr? I believe so. And if it isn’t, it’s can be simply some other alternative to ultimately end up the doubters mistaken. Glad making an investment, Glad New 12 months, and thanks for studying!

If you happen to favored this publish, imagine signing up for my e-newsletter or trying out my prior paintings in ebook shape.

That is publish 378. Any code I’ve associated with this publish will also be discovered right here with the similar numbering: https://github.com/nmaggiulli/of-dollars-and-data